GST Big Relief 2025: 2 Slabs Only, Common People Rejoice

Table of Contents

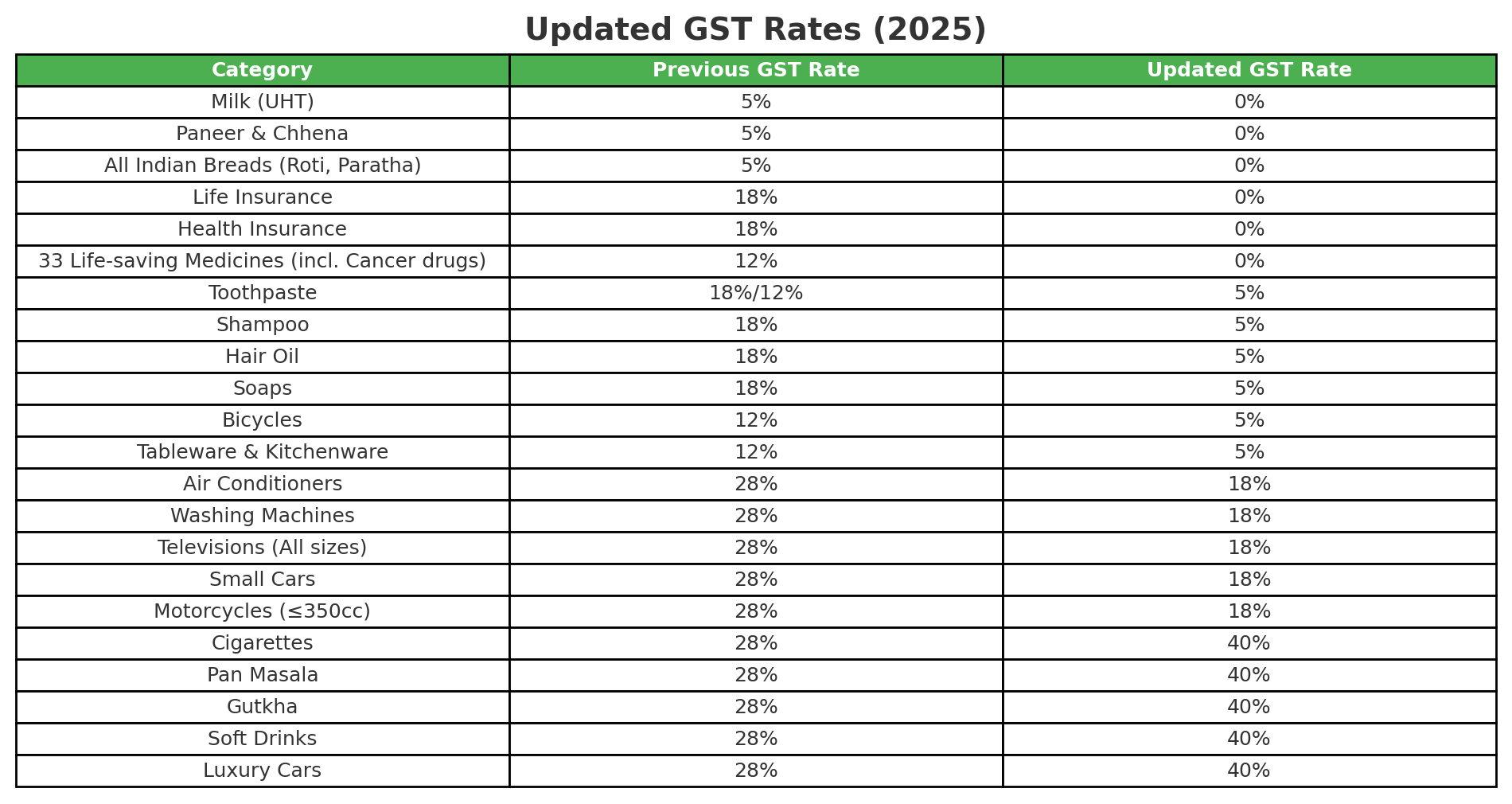

India’s Historic GST Big Reform

The Government of India has announced a historic decision on the Goods and Services Tax (GST), which is set to bring massive GST big relief to common citizens and businesses alike. For the first time since GST was implemented in July 2017, the four-tier structure of 5%, 12%, 18%, and 28% has been simplified into just two slabs—5% and 18%. This change will come into effect from 22 September 2025, coinciding with the start of Navratri, making it a festive gift for millions of Indians.

The move is being seen as a masterstroke to reduce inflationary pressure, boost consumer spending, and simplify the tax structure that has often been criticized for being too complex. With this reform, GST big relief is not only reaching households but also small traders, manufacturers, and service providers.

Why GST Was Introduced in the First Place

Before we dive deeper into the recent announcements, let’s recall why GST was introduced. The Goods and Services Tax replaced a complex web of indirect taxes like VAT, excise duty, service tax, octroi, and entry tax. The idea was to create a “One Nation, One Tax” system.

While GST has helped integrate the Indian economy and improved tax compliance, multiple tax slabs often confused both consumers and businesses. Critics argued that too many rates made it complicated to understand what qualifies as essential vs. luxury.

The new reform, bringing down GST to two slabs, is a long-awaited simplification that finally provides GST big relief to the masses.

GST Relief for Food Items and Daily Essentials

Food is a sensitive category for any government policy, and here the GST relief is most visible. The government has made milk, bread, paneer, roti, and paratha completely GST-free. This is expected to bring down the household food budget significantly.

In addition, other essential items like toothpaste, shampoo, hair oil, soaps, and bicycles have seen their tax rates reduced from 12% or 18% to just 5%. These are items that almost every household uses daily, so the relief is widespread and impactful.

For example, a ₹100 shampoo bottle that earlier cost ₹118 after 18% GST will now cost only ₹105 after 5% GST. That’s direct GST relief of ₹13 on a single purchase. Imagine the savings when multiplied across millions of households.

Relief for Healthcare and Insurance

One of the biggest surprises in this announcement is that life insurance and health insurance are now GST-free. Earlier, these services attracted 18% GST, which made premiums costlier.

Now, a family paying ₹20,000 annually as health insurance premium will save ₹3,600 instantly under the new regime. This GST relief is especially important in a country like India where out-of-pocket healthcare expenses are already very high.

Even life-saving medicines have received exemptions. A total of 33 medicines, including three crucial cancer drugs, are now outside the GST net. This step will not only save lives but also bring financial relief to patients and families.

Electronics and Consumer Durables: Moderate GST Relief

Electronics like air conditioners, washing machines, and televisions were previously taxed at the highest slab of 28%. Now, these have been shifted down to 18%. While they are still not cheap, the reduction brings moderate GST relief for middle-class families looking to purchase such goods during the festive season.

For example:

- A 32-inch LED TV that cost ₹28,000 plus 28% GST (₹7,840) totaling ₹35,840 will now cost only ₹33,040 after 18% GST.

- That’s a saving of ₹2,800 for just one television set, a clear case of GST big relief that can drive demand in the consumer durable market.

The Tough Side: 40% Slab on Luxury and Sin Goods

While most categories saw GST relief, the government has tightened its grip on luxury and harmful products. Items like cigarettes, pan masala, gutkha, soft drinks, and luxury cars are now placed under a special 40% slab.

This is seen as a dual-purpose move:

- Discouraging consumption of harmful goods.

- Ensuring the government does not lose too much revenue while giving GST relief elsewhere.

For consumers of these goods, this is negative news, but from a public health and fiscal standpoint, the step makes sense.

Impact on Small Businesses

Small traders and shopkeepers often found GST compliance difficult due to frequent filings and multiple tax slabs. Now, with only two slabs, filing becomes easier, and the government has also announced a simplified GST registration scheme for small businesses.

This means lower compliance costs, faster approvals, and easier billing—clear GST Big relief for India’s vast small-business community.

Economic Impact of GST Big Relief

Economists believe this step will have multiple ripple effects:

- Boost in consumption: With essentials becoming cheaper, household spending will rise.

- Ease of compliance: Simplification of tax rates means less confusion and better compliance.

- Control on inflation: Lower GST rates on essentials reduce inflationary pressures.

- Balanced revenue: The 40% slab on luxury items ensures government revenue remains strong.

Overall, the reform is expected to make GST more consumer-friendly while keeping government coffers healthy—a win-win GST relief scenario.

Opposition Reactions and Expert Views

While ruling party leaders are calling this a “historic step,” opposition parties argue it comes late. They say GST big relief should have been given years ago, especially during the pandemic.

Tax experts, however, are largely positive. They believe that reducing GST slabs was a demand from both industry and economists, and now India’s GST is closer to global best practices.

Conclusion: A Festival Gift of GST Relief

With this major reform, the government has not only simplified taxation but also won goodwill from common citizens. Essential goods are cheaper, healthcare is more affordable, and compliance for businesses is easier.

The GST big relief is likely to stimulate the economy ahead of the festive season, boost consumer confidence, and make India’s indirect tax system much more transparent and efficient.

The road ahead will show how effectively the new system works, but for now, both consumers and traders have reasons to celebrate.

FAQs

Q1: From when will the new GST rates apply?

The new GST rates will apply from 22 September 2025, the first day of Navratri.

Q2: Which items are now completely GST-free?

Milk, bread, paneer, roti, paratha, life insurance, health insurance, and 33 life-saving medicines are GST-free.

Q3: What is the highest GST rate now?

The highest GST rate is a special 40% slab, applicable to cigarettes, pan masala, gutkha, soft drinks, and luxury cars.

Q4: How does this help small businesses?

With only two slabs and a simplified GST registration scheme, small businesses will face less compliance burden.

Q5: Will electronics get cheaper?

Yes, goods like TVs, ACs, and washing machines have moved from 28% to 18%, giving moderate price reductions.